It seems we’ve entered yet another rout in the metals and mining stocks with several of the companies we follow closely getting sold off, testing their recent lows. It’s frustrating. One would think that with events over the past two weeks, gold would be ripping higher, tagging all-time historical highs. There’s been a lot of […]

Search results

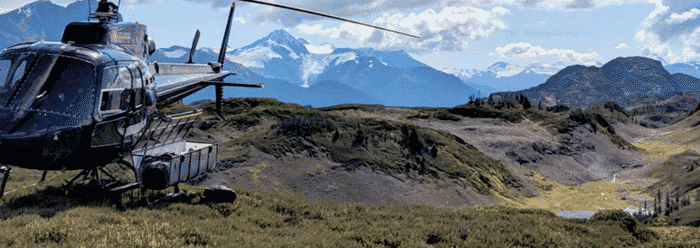

Prime Mining (PRYM.V) – a new addition to the Highballer shortlist

A new addition to the Highballer shortlist—Prime Mining (PRYM.V). 85.57 million shares outstanding $130.07M market cap based on its last trade at $1.52 Prime is helmed by a top-shelf crew, a combination of successful capital markets mining executives and experienced local operators. This team has multiple wealth-creating exits under their collective belts. You can peruse […]

Precious Metals on a Tear – a Roundup of Companies Worth a Close Look Plus a Forum Energy Metals Update

Gold is on a tear, carving out fresh all-time highs as a matter of routine. Short-term (shallow) corrections aside, the metal’s momentum has been impressive, up roughly 27% since the start of the year. Where the equities are concerned, the Bigs appear to be under steady accumulation as per the GDX (chart below). Many of […]

Forum Energy Metals (FMC.V) preps to drill flagship U3O8 project in Nunavut, announces key new hire

With Spot Uranium testing triple-digits—currently trading at $100/lb—those in the bull camp believe the momentum witnessed over the past eight months will continue. Unabated. The fundamentals underpinning the energy-dense metal are highly supportive as the world looks to rebuild supply chains that have all but vanished. While many of the higher-quality equities have tacked on […]

A Junior Sector Roundup plus an update on Forum Energy Metals (FMC.V)

The bear market in junior (exploration) equities has become so entrenched, so protracted that many are questioning whether we’ll ever see a return to normal valuations, let alone a raging bull market. But at the risk of coming off as a lone voice in the wilderness, I’m confident we’ll see a meaningful turn in the […]

A February 21 Roundup featuring Forum (FMC.V), Goldseek (GSK.C), Patriot (PMET.V) and others

Gold continues consolidating its steep run launched in early November 2022. It recently tested support at $1825 after slipping through its 50-period SMA. Amidst this volatility, news events dictate trade as rattled (twitchy) investors attempt to glean the Fed’s next move. The current weakness in the metal weighs heavy on many of the stocks we […]

A Feb. 6 Highballer Roundup featuring Patriot (PMET), Apollo (APGO), Teuton (TUO), and Forum (FMC)

Gold: What initially looked like the early stages of an assault on last April’s highs ended in a freefall back below $1900. After eight consecutive weeks of steady accumulation, this correction might represent a healthy pause before the next leg higher. And there might be enough gravitation pull to yank the metal back into the $1825 […]

A Highballer Roundup for December 6 featuring a host of names – familiar and new

I’ll dispense with my usual preamble blather, cept to say… Gold stocks, as per the GDX, are up roughly 30% from their 2022 lows. Gold stocks are stronger than all other major indexes. The GDXJ is up closer to 40% from its 2022 low. My point: this recent breakout could mark the initial stages of […]

Forum Energy Metals (FMC.V) mobilizes drill rig to Athabasca Basin – a Q&A with Forum’s Wheatley and Hunter + a word on i-80 Gold (IAU.TO)

Forum Energy Metals released two pieces of news in recent sessions that set the stage for a highly anticipated drilling campaign on the edge of the prolific Athabasca Basin in Saskatchewan. (click on the images below to amplify) Wollaston Aside from its strategic location 10 kilometers south of Cameco’s Rabbit Lake mine/mill and 30 kilometers […]

A Nov. 8 Highballer report updating the companies on our list PLUS a few new names that may represent good value at this juncture

Just as Gold appeared to be in the process of breaking major support last week, it staged a dramatic reversal after tagging a fresh 52-week low. On the weekly chart, it staged an outside reversal (taking out the previous week’s low and closing above the previous week’s high). Interesting price action. As has been the […]